Credit Cube - Your Path To A Brighter Financial Future

Finding your way with personal finances can feel a bit like trying to solve a puzzle, can't it? It's not always simple to figure out how to keep your money matters in good shape, or how to make choices that truly help you get ahead. Many folks look for a helping hand, someone to offer a bit of guidance when they are thinking about their spending or saving. That's where a service focused on making things clearer and simpler for you comes into play. It is, you know, about making sure your money picture stays strong and supports the life you want to build.

We often hear about how credit can be a big deal, and for good reason. It plays a pretty big part in many of the financial things we do, from getting a place to live to buying a car, or just having a little extra help when you need it. The main idea behind a service like Credit Cube is to give your credit a boost, keep it well, and stand by you as you make important money moves. It's about giving you the tools and the support you might need to feel more sure-footed with your finances, so you can, like, make good choices.

Whether you are just starting to think about building a financial track record, or you are looking for ways to improve what you already have, knowing where to turn for some friendly help can make all the difference. This piece will walk you through how Credit Cube works to support people like you, offering different ways to get money when you need it, and how they think about helping you build a healthier financial standing. It’s about making things a little less confusing, in a way.

Table of Contents

- What's the Big Idea Behind Credit Cube?

- How Credit Cube Helps Your Financial Picture

- Credit Cards and Your Spending Power - What Should You Know?

- Building a Strong Foundation with Credit Cube

- Is Getting a Loan with Credit Cube Easy?

- The Credit Cube Way - Rewarding Loyal Customers

- How Does Credit Cube Help Your Credit Score?

- Connecting with Credit Cube on the Go

What's the Big Idea Behind Credit Cube?

At its heart, the whole point of a place like Credit Cube is to give you a hand with your credit. It's about more than just getting money; it is about helping you make your credit stronger, keeping it in good shape over time, and giving you backing when you need to make important money decisions. They are, you know, there to support you if you need some guidance on your personal finances. This means looking at your overall financial well-being, not just one small piece of it. It's about providing a safety net, in a way, for your financial standing.

Think of it like this: your credit standing is a big part of your financial life. It affects whether you can get a place to live, buy a car, or even get certain jobs. Credit Cube aims to be a partner in this, offering tools and information to help you manage this important part of your life. They want to see you succeed, and that means making sure you have access to what you need to keep your credit healthy. So, it's almost like having a coach for your money matters, which is pretty helpful for most people.

How Credit Cube Helps Your Financial Picture

When it comes to getting a little extra money, or just making sure your financial picture is clear, Credit Cube has a few ways to help. They provide information and services that aim to improve your credit, keep it healthy, and stand by you as you make important choices that might affect your financial well-being. It’s really about giving you options and showing you how to use them wisely. This can mean anything from advice on a specific situation to helping you find a loan that fits your needs, you know.

They are there to give you a bit of advice if you are feeling unsure about something related to your money. This support is meant to give you a clearer idea of your options and how different choices might play out for your financial health. It’s not just about giving you money, but also about helping you think through how you use it. So, in some respects, it is about empowering you to make good decisions for yourself.

Credit Cards and Your Spending Power - What Should You Know?

Credit cards are a pretty common way for people to have a spending limit available without needing to carry cash or have money sitting in their bank account right away. They give you a bit of freedom to buy things when you need them, and then you pay for them later. Some of these cards are what we call 'secured' or 'prepaid', and these usually ask you to put down some money first before you can use them. This acts like a safety deposit, which is pretty typical for those just starting out or looking to rebuild their financial standing, you know.

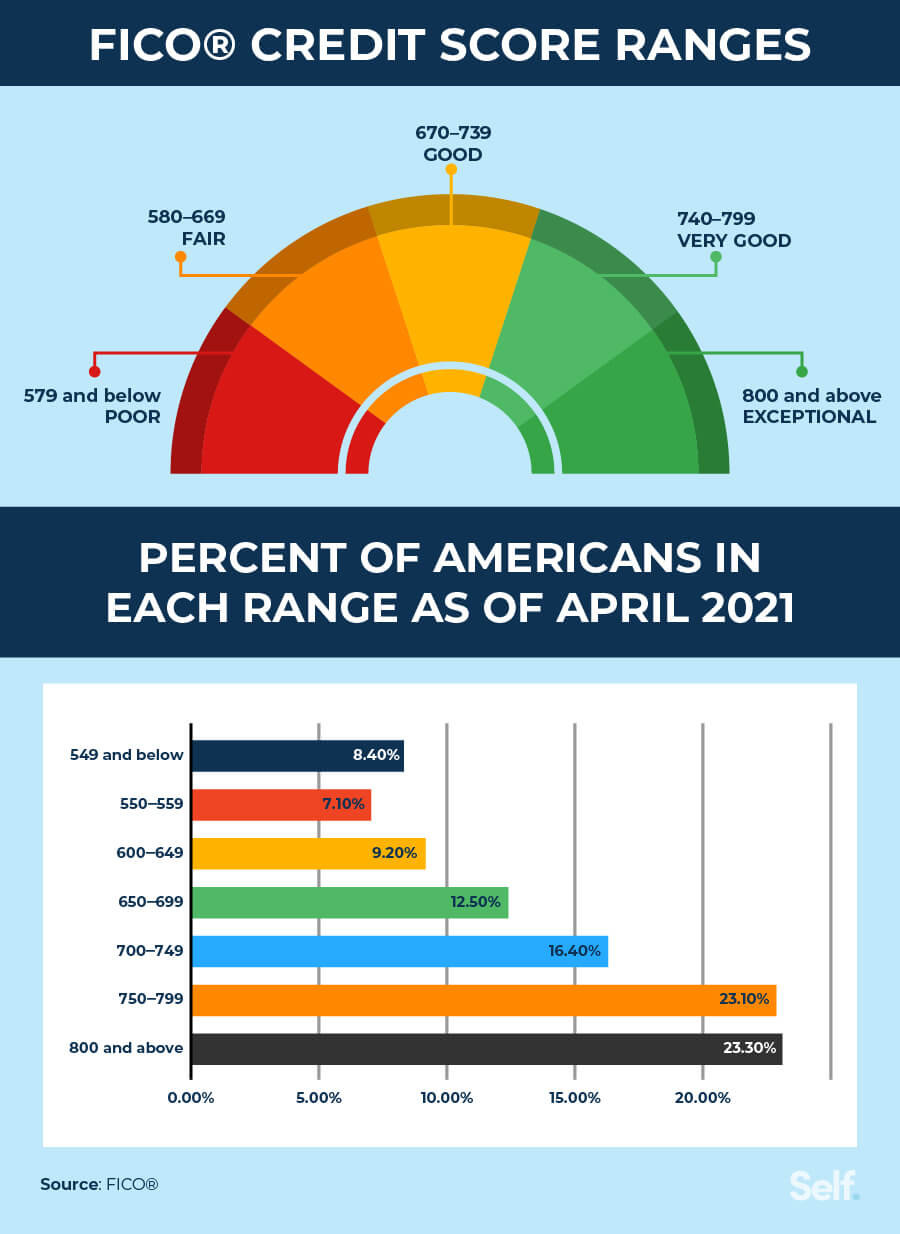

Having a good credit score means you can usually get approved for most credit cards out there. Not only that, but you should also be able to get a pretty decent spending limit based on how much you earn. This is because lenders see you as someone who pays their bills on time, which makes them more comfortable giving you access to more money. It's like building a good reputation, so to speak, in the money world. Your credit score is a big piece of that, apparently.

Beyond credit cards, there are other ways to get money when you need it, like a personal line of credit. This is a kind of personal loan that is very handy and offers a lot of wiggle room. It means you can borrow money as you need it, up to a certain amount, and only pay interest on what you actually use. This kind of arrangement can be really useful for unexpected costs or for managing cash flow. It’s a flexible way to get financial help, and it’s something many people find quite helpful, actually.

Building a Strong Foundation with Credit Cube

When you are thinking about your financial standing, building a solid base is key. Credit reports, which are put together by big credit reporting companies, play a huge part in helping you build your financial reputation. They keep track of how you handle money you borrow, and this information helps others decide if they want to lend to you. Credit Cube understands this, and they work to help you use these tools to your advantage. It’s about making sure your financial story looks good on paper, you know.

For those who are looking to make their credit scores better, Credit Cube can be a really helpful tool. By borrowing money responsibly and making sure you pay back what you owe on time, you can show that you are a reliable person when it comes to money. This kind of behavior helps to improve your score over time. It’s like practicing a skill; the more you do it right, the better you get. So, in a way, Credit Cube gives you a chance to practice being financially responsible.

Is Getting a Loan with Credit Cube Easy?

Applying for a loan with Credit Cube is designed to be pretty simple and quick. The whole process for a loan application usually takes only a few minutes, which is really convenient. One of the nice things about applying is that it doesn't affect your FICO® score. This means you can check out your options without worrying about it having a negative mark on your financial standing, which is a big plus for many people. This is, like, a really important feature for those who are cautious about their credit.

Typically, if you are looking for quick loans and you apply with an online lender, the process is streamlined to make it as easy as possible. Credit Cube follows this idea, making it straightforward to get the help you need when you need it. They want to make sure that getting access to funds isn't a long, drawn-out process. So, it's almost as if they've thought about what makes things difficult for people and tried to remove those barriers.

They have also received some good feedback from people who have used their services. For instance, some folks have shared that Credit Cube has helped them with smaller loans, and they have been able to get extra money on a couple of occasions in the past. This shows that they are there to assist with real-life needs. It's good to hear from actual people, you know, about their experiences.

The Credit Cube Way - Rewarding Loyal Customers

Credit Cube has a special way of saying thank you to its most valued customers through its loyalty program. This program gives people who keep coming back access to bigger loans and interest rates that get smaller over time. This makes getting credit much more reachable for them, especially when they need it the most. It's their way of making sure that people who are in need of credit aren't left without good options. They really want to support those who stick with them, apparently.

Joining the Credit Cube loyalty program means you get to enjoy special benefits. These can include rates that are lower and loan amounts that are higher. The more you borrow responsibly and pay back on time, the more you can save through their rewards program. It's a system that tries to give back to those who are consistent and trustworthy. This kind of program is pretty unique and can make a real difference for regular users, in a way.

How Does Credit Cube Help Your Credit Score?

Credit scores are updated regularly as new information about your payments and financial activities comes in. This means you need to be ready for what might happen if you are having trouble paying your bills. Missing payments can quickly affect your score. Credit Cube helps you by giving you a way to show you can manage money responsibly. When you borrow from them and pay back on time, that positive activity gets reported, which can help your score go up. It’s a direct path to building a better financial standing, you know.

By using Credit Cube's services, especially by borrowing money and then making sure you pay it back as agreed, you are building a positive payment history. This is one of the biggest factors that goes into figuring out your credit score. Showing that you are reliable with money is key. So, in some respects, Credit Cube gives you a tool to actively work on improving your financial reputation, which is really valuable.

Connecting with Credit Cube on the Go

For those who like to manage their money from their phone, Credit Cube has a mobile application. This app lets people apply for loans, keep an eye on their accounts, and make payments all from one spot. It’s designed to be super convenient, letting you take care of your financial needs wherever you are, whenever you want. This kind of easy access is pretty important for a lot of people today, you know, who are always on the move.

If you are curious to learn more about Credit Cube and what they offer, you can check out the services they have available. You can also look at what other people in the community have said about their experiences. Reading reviews from others can give you a good idea of what to expect and how the service has helped real people. This transparency helps you make a choice that feels right for you. It’s like getting feedback from friends before you try something new, basically.

The mobile app has received some good marks from users. For example, it has a 3.9 out of 5 rating with over 14,900 reviews and more than a million downloads on one app store. Another version shows a 4.7 out of 5 rating from 129 reviews. These ratings suggest that many people find the app useful and easy to use, which is pretty reassuring for new users. It shows that they are doing something right, in a way, for their customers.

New Way To See Free Credit Scores From FICO | Kiplinger

What Does a 600 Credit Score Mean? Understanding Your Rating

Credit Score Ranges Uk at Leonard Stewart blog